Roche has set its sights on becoming a “top three” obesity company, according to the pharma’s long-awaited strategy for cracking the weight loss market.

Addressing a conference room full of investors in London this morning, Roche Pharma CEO Teresa Graham emphasized that she was “serious about this goal.”

The aim is to become a “strong entrant” into the obesity space “before 2030” thanks to “competitive products,” Graham explained during her presentation at Roche’s Pharma Day.

“I believe we have the pipeline; I believe we have the commercial capabilities; and, most importantly, I believe we have the will,” Graham said.

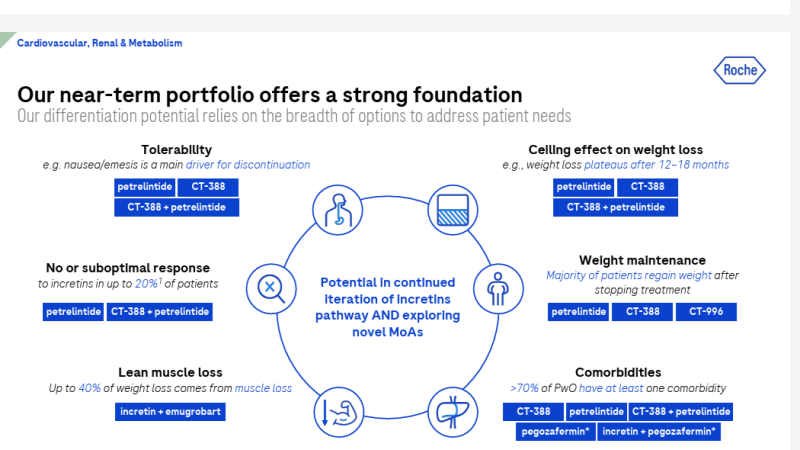

Roche entered the obesity space in December 2023 by buying Carmot Therapeutics for $2.7 billion. While Roche discarded one of Carmot’s preclinical obesity drugs earlier this year, the Big Pharma confirmed today that it is planning to take Carmot’s lead candidate—an injectable dual GLP-1/GIP receptor dubbed CT-388—into a phase 3 study in the first half of next year.

Meanwhile, Carmot’s oral GLP-1 CT-996, which posted some promising early-stage clinical results in 2024, began a phase 2 study this year, according to the presentation.

Roche further cemented its weight loss ambitions in March via a $1.6 billion upfront deal to codevelop and co-commercialize Zealand Pharma’s long-acting amylin analog petrelintide. But the company had not outlined a cohesive strategy for its various obesity assets—until today.

“I know many of you have been waiting for this,” Graham acknowledged to investors at this morning’s event.

“To sum it up, our capabilities strongly position us to deliver here,” Graham continued. “From multiple pipeline assets of best-in-class and best-in-disease potential, the ability to leverage synergies across the portfolio, our global robust manufacturing network, our presence in more than 150 countries with our global commercial footprint and, of course, our very unique ability to leverage our pharma-dia[gnostics] connection, we believe that those capabilities, in total, executed correctly, will allow us to become a top three player in obesity.”

“We are committed to making that happen,” she added.

The company is eyeing peak sales of more than $3 billion for both CT-388 and petrelintide, according to Roche’s presentation.

The idea is that combining assets across Roche’s wider portfolio could help differentiate the pharma’s offering. For example, combining CT-388 with petrelintide could address nausea, which is the main driver of discontinuation from existing weight loss products. The acquisition of 89bio last week also adds the possibility of using the biotech’s phase 3-stage fatty liver disease drug pegozafermin to address some of the comorbidities of obesity.

The difficulties with securing and maintaining a top spot in obesity become apparent in recent months, with Novo Nordisk launching a major restructure in the wake of underwhelming data for its next-gen obesity portfolio, while Pfizer almost abandoned the field completely.

Still, the continuing attractiveness of the obesity space for Big Pharmas was demonstrated this morning by Pfizer’s decision to redouble its weight loss efforts via the acquisition of Metsera for its clinical-stage incretin and amylin programs.